The smart Trick of Hard Money Atlanta That Nobody is Discussing

Wiki Article

The 9-Second Trick For Hard Money Atlanta

Table of ContentsThe Buzz on Hard Money AtlantaThe 5-Minute Rule for Hard Money AtlantaSee This Report about Hard Money AtlantaThe 8-Minute Rule for Hard Money Atlanta7 Easy Facts About Hard Money Atlanta Described

These jobs are usually finished rapidly, for this reason the requirement for fast access to funds. Benefit from the job can be used as a deposit on the next, therefore, tough money finances enable capitalists to scale and also turn even more properties per time - hard money atlanta. Provided that the fixing to resale time framework is brief (usually much less than a year), house flippers do not require the long-term finances that traditional home loan lending institutions provide.Conventional loan providers might be thought about the reverse of difficult cash loan providers. What is a difficult cash loan provider?

Generally, these variables are not one of the most vital factor to consider for car loan qualification (hard money atlanta). Rather, the worth of the property or asset to be purchased, which would certainly also be made use of as security, is largely taken into consideration. Interest rates may also differ based on the loan provider as well as the sell inquiry. Most lending institutions might charge rate of interest rates varying from 9% to also 12% or even more.

Hard cash lending institutions would certainly also bill a cost for giving the finance, and also these charges are also called "factors." They typically wind up being anywhere from 1- 5% of the overall funding amount, nonetheless, factors would typically equate to one portion point of the funding. The major difference between a tough money lender and also other loan providers hinges on the approval process.

Hard Money Atlanta - The Facts

A hard cash lender, on the other hand, concentrates on the possession to be bought as the top consideration. Credit report, earnings, and also other individual demands come secondary. They additionally differ in regards to convenience of access to financing and also rate of interest; hard money lending institutions provide funding swiftly and charge higher rate of interest too.You can locate one in among the following ways: An easy internet search Request recommendations from local realty agents Request suggestions from genuine estate financiers/ financier groups Because the lendings are non-conforming, you should take your time evaluating the requirements and also terms supplied prior to making a calculated and educated choice.

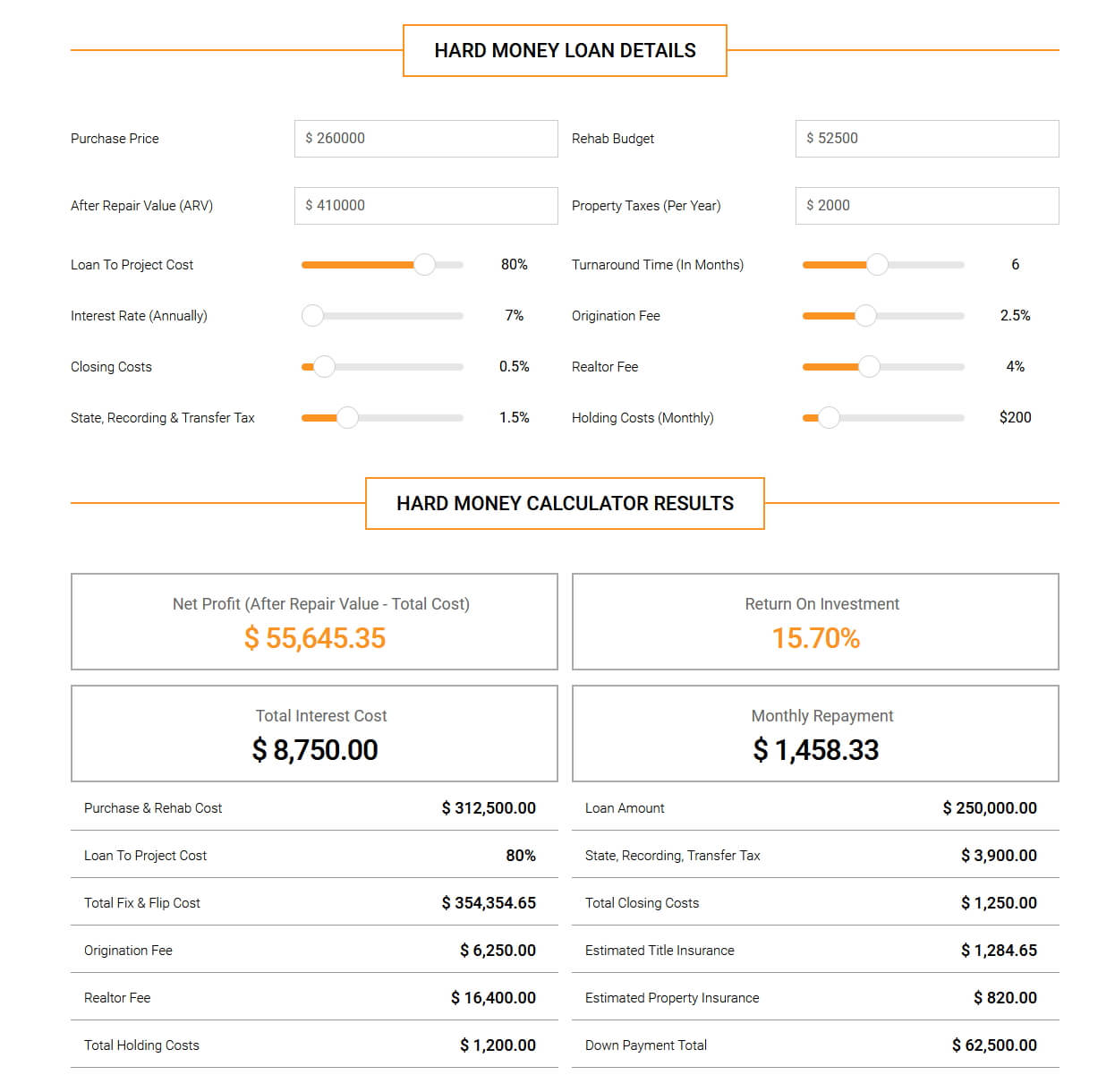

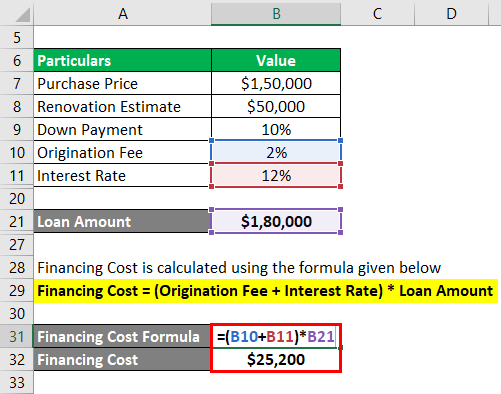

It is important to run the figures prior to deciding for a tough money finance to make sure that you do not face any loss. Use for your tough money lending today and obtain a financing dedication in 24 hr.

These lendings can usually be acquired quicker than a standard financing, and often without a large down repayment. A tough money lending is a collateral-backed financing, safeguarded by the property being bought. The size of the lending is identified by the estimated value of the building after suggested fixings are made.

Hard Money Atlanta Things To Know Before You Buy

A lot of tough money car loans have a regard to six to twelve months, although in some instances, longer terms can be organized. The borrower makes a month-to-month payment to the loan provider, usually an interest-only repayment. Below's just how a regular difficult money finance works: The customer wishes to purchase a fixer-upper for $100,000.

Some lenders will call for more cash in the offer, and also ask for a minimum down payment of 10-20%. It can be beneficial for the investor to choose the lenders that call for very little deposit alternatives to minimize their cash to close. There will likewise be the typical title fees connected with closing a deal.

See to it to consult the tough money lender to see if there are prepayment penalties charged or a minimum yield they require. Assuming you remain in the loan for 3 months, and the property costs the predicted $180,000, the financier earns a profit of $25,000. If the residential property costs greater than $180,000, the buyer makes also more cash.

Because of the shorter term and high passion prices, there typically needs to be restoration and upside equity to capture, whether its a flip or rental home. First, a difficult cash funding is ideal for a purchaser that intends to repair and also turn an undervalued residential property within a relatively short amount of time.

Not known Facts About Hard Money Atlanta

It is vital to know exactly how tough cash loans work and also just how they vary from conventional car loans. These traditional loan providers do not usually deal in tough cash financings.

The Basic Principles Of Hard Money Atlanta

When getting a tough money lending, consumers need to confirm that they have sufficient resources to effectively survive an offer. Having previous property check this site out experience is likewise an and also. When considering just how much money to provide, several difficult browse this site cash lenders think about the After Repaired Value (ARV) of the residential or commercial property that is, the approximated value of the home nevertheless improvements have actually been made.Report this wiki page